SBI Education Loan Scheme is provided by State Bank of India (SBI) for the benefit of the students, Under this scheme students can avail the loan facility to sponsor their studies till the completion of the course and can repay the loan value after they get a job on behalf of their educational qualification. SBI Education loan proves to be beneficial for the students facing financial hindrance in their education. SBI Education Loan Interest Rate are also reasonable to the students applying for it and it differs from each scheme.

SBI Education Loan has the following four Education Loan Scheme for different sections of people:

- SBI Student Education Loan

- SBI Scholar Loan

- Vocational Loan

- Global Ed-vantage

Note: Applicants can apply for any of the loan schemes via application form given below this page.

SOF Olympiad Qualified Candidates are eligible for ALLEN Champ

SBI Youth for India Fellowship Programme

SBI Education Loan details are provided in the article below, and all the four Education Loan Scheme are discussed below:

1. SBI Student Education Loan Details

SBI Student Loan is granted to Indian Nationals for pursuing higher education in India or abroad where they have taken admission. SBI Student Education Loan repayment period is up to 15 years after the Course period + 12 months of Repayment Holiday. SBI will charge no processing or any upfront charges on the levied Education loans.

Courses Covered

Studies in India

- Graduation, Post-Graduation including regular technical and professional Degree/Diploma courses conducted by colleges/universities approved by UGC/AICTE/IMC/Govt. etc.

- Regular Degree/Diploma courses conducted by an autonomous institution like IIT, IIM, etc. Other Regular Degree/Diploma Courses like Aeronautical, pilot training, shipping, etc. approved by Director General of Civil Aviation/Shipping/concerned regulatory authority.

- Teacher Training/Nursing Courses approved by Central Government or the State Government.

Studies Abroad

- Job oriented professional/technical Graduation Degree courses/Post Graduation Degree and Diploma courses like MCA, MBA, MS, etc. offered by reputed universities.

- Courses conducted by Chartered Accountant of Management Accountants (CIMA), Certified Public Accountant in USA etc.

Expenses Covered

- College/school/hostel fees

- Examination/Library/Laboratory fees

- Purchase of Books/Equipment/Instrument/Uniforms, purchase of computers essential for completion of the course (maximum 20% of the total tuition fees payable for the completion of the course)

- Caution Deposit/Building Fund/Refundable Deposit (Maximum 10% of the tuition fees for the entire course)

- Travel Expenses/Passage money for the studies abroad

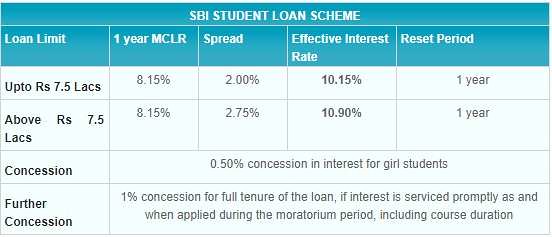

SBI Education Loan Interest Rate

The applicants can avail the following given loan amount, and the rate of interest on the loan amount is discussed below.

- For Studies in India - 10 lakhs maximum

- Studies Abroad - 20 lakhs maximum

Repayment of SBI Education Loan

- Repayment will start one year after the completion of the course

- The loan should be repaid in 15 years after the commencement of repayment

- In case the second loan is available for higher studies later, to repay the combined loan amount in 15 years after the completion of the second years.

2. SBI Scholar Education Loan Details

SBI Scholar Education Loan is for pursuing higher education in the selected list of 120 top institutions in India that list is given below on this page. SBI Scholar Education Loan provides 100% financing fee, No Processing Fee, Quick sanction at Designated Campus Branch or more than 5000 selected branches all over the country.

Repayment Period: Up to 15 years after the course period + 12 months of repayment holiday. In case the second loan is availed for higher studies later, to repay the combined loan amount in 15 years after the completion of the second course.

Courses Covered

- Regular full-time Degree/Diploma courses through entrance test/selection process

- Full-time Executive Management courses like PGPX

- No certificate/Part time courses

Expenses Covered

- College/School/Hostel Fees

- Examination/Library/Laboratory fees

- Purchase of Book/Equipment/Instruments

- Caution Deposit/Building fund/refundable deposit supported by Institution bills/receipts which not exceed 10% of the tuition fees for the entire course.

- Travel Expense/expense on exchange programme

- Purchase of computer/laptop

- Any other expense related to education

SBI Loan Amount & Security

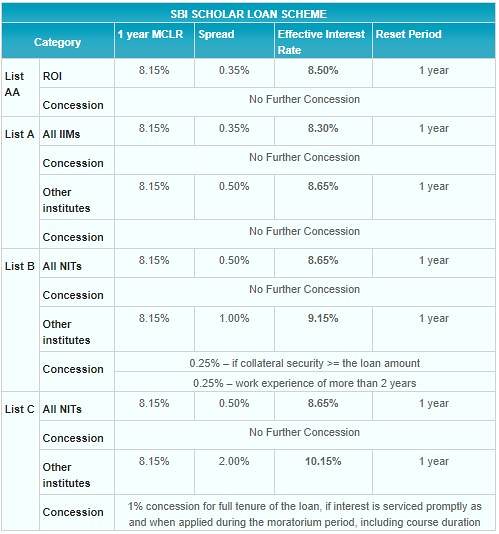

The loan amount is different for the category given in the list of the Institutions, and the maximum loan amount is provided in the table below:

|

Category |

Maximum Loan Limit |

|

|

No Security, only parent/guardian as co-borrower |

With tangible collateral or full value and parent/guardian as co-borrower |

|

|

List AA |

Rs. 30 lacs |

- |

|

List A |

Rs. 20 lacs |

Rs 30 lacs |

|

List B |

Rs. 7.5 lacs |

- |

|

List C |

Rs. 7.5 lacs |

Rs 30 lacs |

SBI Interest Rate

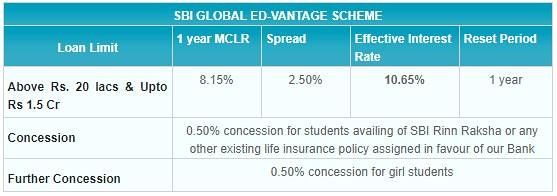

3. SBI Global Ed-vantage Scheme Details

SBI Global Ed-vantage is an overseas education loan exclusively for those who wish to pursue full-time regular courses at foreign colleges/universities. The Key features of SBI Global Ed-vantage scheme are:

- Faster: Online application process

- Lighter: Attractive interest rate

- Higher: Loan amount through EMI up to Rs. 1.5 crore

- Easier: Repayment through EMI up to 15 years

Courses Covered

Regular Graduate Courses/Post Graduate/ Doctorate courses in any discipline offered by foreign Institutes/Universities in USA, UK, Canada, Australia, Europe, Singapore, Japan, Hong Kong and New Zealand.

Expenses Covered

- College/school/hostel fees

- Examination/Library/Laboratory fee

- Travel Expenses/Passage money for studies abroad.

- Purchase of books/equipment/instruments/uniforms/ computer at reasonable cost, if required for course completion and any other expense required to complete the course– like study tours, project work, thesis, etc. can be considered for loan subject to the condition that these should be capped at 20% of the total tuition fees payable for completion of the course.

- Caution deposit /building fund/refundable deposit supported by Institution bills/receipts the amount considered for loan should not exceed 10% of the tuition fees for the entire course.

- The premium of ‘RiNn Raksha’ (IRDA License No: UIN: 111N078V01): Finance for ‘RiNn Raksha’ will improve insurance coverage of the loan.

SBI Loan Interest Rate

Repayment

- Accrued interest during the moratorium to be added to the principal and repayment in EMI fixed.

- Repayment will commence six months after completion of course

- Repayment up to maximum of 15 years

4. SBI Vocational or Skill Loan Scheme Details

SBI Vocational or Skill Loan Scheme are granted to the Indian Nationals for pursuing Skill development courses in India.

Courses Offered

- Training Institutes Courses: The courses run by Industrial Training Institute (ITIs), Polytechnics, training partners affiliated with National Skill Development Corporation (NSDC)/ Sector Skill Councils, State Skill Mission, State Skill Corporation, preferably leading to a certificate/diploma/degree issued by such organization as per National Skill Qualification Framework (NSQF) are eligible for a Skilling Loan.

- Schools recognised by Central or State Education Boards or Colleges affiliated to recognised university leading to a certificate/diploma/degree issued by such organisation as per National Skill Qualification Framework (NSQF) is eligible for a Skilling Loan.

Expenses covered

- Tuition / Course Fee

- Examination / Library / Laboratory fee

- Caution deposit

- Purchase of books, equipment and instruments

Any other reasonable expenditure found such as localised boarding, lodging may not be necessary for completion of the Course. However, wherever it is found necessary, the same could be considered on merits).

Interest Rate

The applicants can avail the following given loan amount, and the rate of interest on the loan amount is discussed below.

- The minimum loan amount: Rs 5000

- The maximum loan amount: Rs 1,50,000

1.50% above MCLR, currently 10.40% p.a. 1% concession is provided for the full tenure of the loan, if interest is serviced promptly as and when applied during the moratorium period, including course duration.

Repayment Tenure

|

Loan Amount |

Repayment Period in years |

|

Loans up to Rs 50,000 |

Up to three years |

|

Loans between Rs 50,000 to 1 lakh |

Up to 5 years |

|

Loans above Rs. 1 Lakh |

Up to 7 years |

SBI Education Loan Application Form - Apply Online

The aspirants who want to apply for any of the above four SBI Education Loan can apply online on the official website of State Bank of India that is www.sbi.co.in.The candidates need to follow few steps in order to apply online.

Click Here to Apply Online

Documents required to apply for the SBI Education Loan 2019

The following documents will be required for all those who are applying for the above given four SBI Education Loan Scheme:

- Letter of admission

- Completely filled in Loan Application Form

- 2 passport size photographs

- Statement of cost of study

- PAN Card of the student and Parent/ Guardian

- AADHAAR Card of the student and Parent/ Guardian

- Proof of identity (Driving Licence/Passport/AADHAAR/ any photo identity)

- Proof of residence (Driving Licence/Passport/Electricity bill/Telephone bill)

- Student/Co-borrower/ guarantor's bank account statement for last 6 months

- IT return/ IT assessment order, of previous 2 years of Parent/ Guardian/ other co-borrower (if IT Payee)

- The brief statement of assets & liabilities of Parent/ Guardian/ other co-borrower

- Proof of income (i.e. salary slips/ Form 16) Parent/ Guardian/ other co-borrower.

Latest Education News on Scholarships / Entrance Exams in India

For any queries related to SBI Education Loan, You can write to us in the comments section below.